How much can you make on a job still draw social security without

Table of Contents

Table of Contents

If you’re nearing retirement age or already retired, the thought of how much you can make while drawing social security benefits might be top of mind. After years of working hard, the prospect of earning additional income on top of your social security benefits might sound appealing. But how much can you really make without impacting your benefits? Let’s dive into the details.

Understanding the Pain Points

As you near retirement age, you may begin to feel anxious about having enough money to live on, especially if current economic conditions make it difficult to find work. Even if you’re already receiving social security, you might wonder if it’s possible to earn additional income without forfeiting some of your benefits. And while it might seem tempting to continue working part-time, accepting a full-time job, or starting a new business, it’s natural to wonder how much financial loss might occur.

How Much Can You Make While Drawing Social Security?

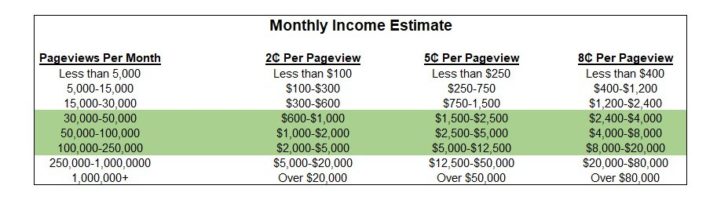

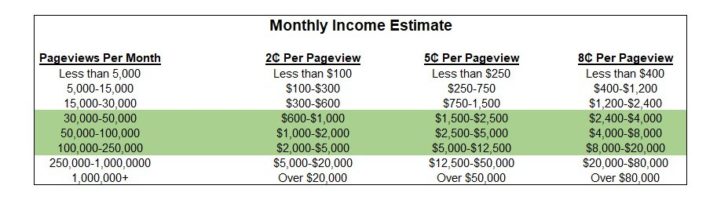

The answer to this question can vary based on your age and when you start to collect your benefits. If you choose to begin collecting social security at your full retirement age, which varies based on your birth year, you can earn up to $50,520 in 2021 without reducing your social security benefits. However, if you earn more than this amount, your benefits will be reduced by $1 for every $2 you earn over the limit. If you decide to start collecting benefits before your full retirement age, you can earn up to $18,960 in 2021 without reducing your benefits. If you earn more than this amount, your benefits will be reduced by $1 for every $2 you earn above the limit. Once you reach your full retirement age, your benefits will no longer be reduced no matter how much you earn.

Main Points to Remember

The key to earning additional income while collecting social security is to stay within the annual limit to avoid benefit reductions. If you’re considering returning to work after retirement, take the time to research how much you can earn based on your age and when you start to collect your benefits. Once you know these numbers, you’ll be better able to plan your income and avoid any unpleasant surprises come tax season.

Personal Experience

One key takeaway to remember is that while social security can help you maintain a certain standard of living, it may not be enough to live comfortably. In my personal experience, I discovered that while my social security benefits were helpful, they did not cover all of my expenses. Coming out of retirement and finding part-time work allowed me to earn additional income while keeping within the annual limit and keeping my benefits intact.

Exploring Other Income Sources

Exploring Other Income Sources

If you need to earn additional income beyond social security, you have several options. One is to pick up part-time work or start a business. Another is to take advantage of the gig economy by driving for a ride-sharing service or delivering packages. Whatever route you decide to take, make sure you stay within your annual limit so your social security benefits remain unaffected.

### Understanding the Benefits of Delaying Benefits

### Understanding the Benefits of Delaying Benefits

While it can be tempting to start collecting social security benefits as soon as possible, delaying benefits could lead to higher payouts in the long run. According to the Social Security Administration, if you delay your benefits until age 70, your monthly payment could be up to 32% higher than if you started collecting benefits at your full retirement age. Of course, this strategy only works if you can afford to delay benefits and continue earning income in the meantime.

If you’re wondering if it’s possible to work full-time and still collect social security, the answer is yes, but there are limits to how much you can earn. If you collect benefits before your full retirement age, you can earn up to $18,960 in 2021 without reducing your benefits. If you collect benefits at full retirement age or older, there is no limit to how much you can earn.

Question and Answer

Question and Answer

Q: What happens if you earn more than the annual limit while drawing social security benefits?

A: If you earn more than the annual limit, your social security benefits will be reduced by $1 for every $2 you earn over the limit.

Q: Can you collect social security benefits if you’re still working?

A: Yes, you can continue working and still collect social security benefits. However, if you collect benefits before your full retirement age, there is an annual limit to how much you can earn without reducing your benefits.

Q: Can you lose your social security benefits if you earn too much?

A: No, you can’t lose your social security benefits entirely. However, your benefits will be reduced if you earn more than the annual limit before reaching your full retirement age.

Q: Is it possible to delay social security benefits and still earn income?

A: Yes, you can delay social security benefits and still earn income, as long as you stay within the annual limit or have reached your full retirement age.

Conclusion of How Much Can You Make While Drawing Social Security

When it comes to collecting social security benefits and earning additional income, it’s important to know your options. By understanding the annual income limits based on your age and start date, you can make smart choices that will help you maximize your income without sacrificing your social security benefits. So take the time to fully understand how much you can make while drawing social security and plan accordingly to ensure a comfortable retirement.

Gallery

View How Much Can A Fashion Blogger Make Images – WallsGround

Photo Credit by: bing.com /

The 3 Best Ages To Start Taking Social Security | The Motley Fool

Photo Credit by: bing.com /

4 Things To Know About Working While Drawing Social Security - Debt.com

Photo Credit by: bing.com /

Custom Essay | Amazonia.fiocruz.br

Photo Credit by: bing.com /

How Much Can You Make On A Job & Still Draw Social Security Without

Photo Credit by: bing.com /